|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

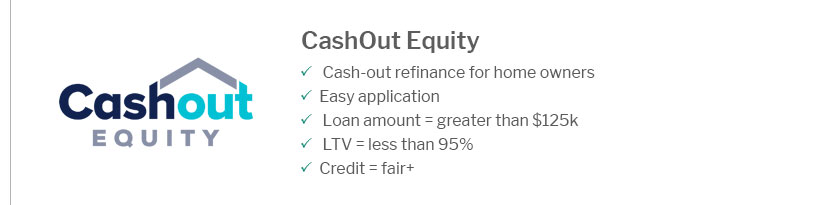

Why Should You Refinance Your House: Key Benefits and ConsiderationsUnderstanding the Basics of RefinancingRefinancing your house involves replacing your current mortgage with a new one, often with different terms. This process can provide various financial benefits, depending on your personal situation and market conditions. Top Reasons to Refinance Your HomeLower Interest RatesOne of the primary reasons homeowners refinance is to take advantage of lower interest rates. This can reduce your monthly payments and save you money over the life of the loan. Changing Loan TermsRefinancing allows you to modify the length of your mortgage. For example, switching from a 30-year to a 15-year term can help you pay off your home faster and reduce total interest paid. Accessing Home EquityIf you have built up significant equity in your home, refinancing can enable you to access cash through a cash-out refinance. This can be useful for home improvements, debt consolidation, or other financial needs. Switching Loan TypesHomeowners may also refinance to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage, providing more stability and predictability in monthly payments.

Understanding when you should refinance mortgage can greatly enhance these benefits. Steps to Refinance Your Home

For more details, consider exploring where to refinance home mortgage to find suitable options. FAQs About Refinancing Your HomeWhat are the costs associated with refinancing?Refinancing typically involves closing costs, which can range from 2% to 5% of the loan amount. These may include appraisal fees, origination fees, and title insurance. How do I know if refinancing is right for me?Consider refinancing if you can secure a significantly lower interest rate, need to change your loan term, or wish to access your home's equity. Evaluate your financial goals and consult with a financial advisor. Can refinancing affect my credit score?Yes, refinancing can temporarily lower your credit score due to the hard inquiry and changes in credit utilization. However, consistent, on-time payments on your new loan can improve your score over time. https://www.investopedia.com/mortgage/refinance/when-and-when-not-to-refinance-mortgage/

One of the best and most common reasons to refinance is to lower your loan's interest rate. Historically, the rule of thumb has been that refinancing is a good ... https://www.citizensbank.com/learning/refinancing-your-mortgage.aspx

Refinancing could lower your interest rate, change your loan type, adjust your repayment term, or cash out available equity. Visit Citizens to learn about ... https://www.rocketmortgage.com/learn/should-i-refinance

Refinancing can allow you to change the conditions of your mortgage to secure a lower monthly payment, get a new loan repayment term, consolidate debt or even ...

|

|---|